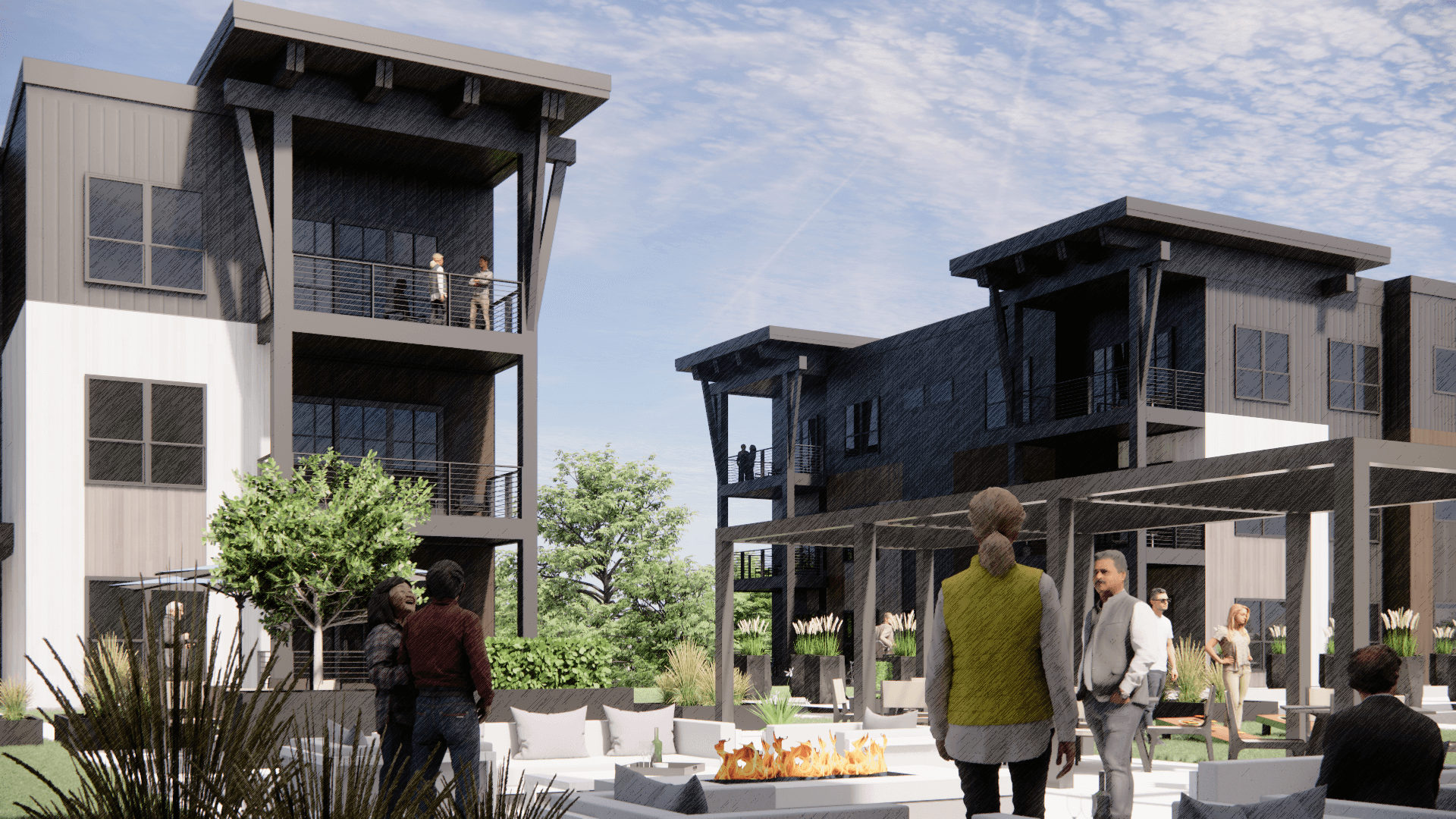

Holland Home Announces Third Senior Living Campus in Ada

Holland Home announced their plans to open a third senior living campus in Ada, the Averden, with hopes to start construction in early 2027. The $215 million planned community will cater to active adults 60+ and will feature 136 independent living residences and a 15-room assisted living center. Learn more! […]

Read More… from Holland Home Announces Third Senior Living Campus in Ada